texas estate tax rate

1 The type of taxing unit determines which truth-in-taxation steps apply. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706 PDF.

Call 940 668-7731 Text 940 251-0701.

. A citys property tax provisions must conform with Texas constitutional rules and regulations. Each are due by the tax day of the year following the individuals death. The fair market value of these items is used not necessarily what you paid for them or what their values were when you acquired them.

Get Results On Find Info. Truth-in-taxation requires most taxing units to calculate two rates after receiving a certified appraisal roll from the chief appraiser the no-new-revenue tax rate and the voter-approval tax rate. Ad Search Texas Inheritance Tax Rate.

We update this information along with the city county and special district rates and levies by August. Truth-in-taxation is a concept embodied in the Texas Constitution that requires local taxing units to make taxpayers aware of tax rate proposals and to afford taxpayers the opportunity to limit tax increases. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

Trina FreemanCity of Arlington Texas tax assessor-collector101 S. Unlike the federal system Texas does not have an estate tax that individuals must pay. Texas has no state property tax.

22 hours agoAccording to the Bell County Appraisal District under the districts approved tax rate an average home appraised at 163228 will owe 1659 in property taxes to KISD for fiscal year 2023. Hours of Operation Monday Thursday 800 AM 500 PM. This data is based on a 5-year study of median property tax rates on owner-occupied homes in Texas conducted from 2006 through 2010.

This rate has not changed in 2022. Texas has one of the highest average property tax rates in the country with only thirteen states levying higher property taxes. The Texas estate tax system is a pick-up tax which means that TX picks up the credit for state death taxes on the federal estate tax return.

This means the most an estate will be taxed is at 40 of the estates total value. The Estate Tax is a tax on your right to transfer property at your death. But in TX this credit is no longer included on the federal estate-tax return.

To discuss the districts fiscal year 2023 budget and to An over 65 hospital district tax freeze item is included under unfinished business as part of the agenda for the boards regular session. The Comptrollers office does not collect property tax or set tax rates. For information about your property value please contact the Tarrant Appraisal District at 817-284-0024.

In past years the highest estate and gift tax rate has been 40. Fisher Investments has 40 years of helping thousands of investors and their families. Use the directory below to find your local countys Truth in Taxation website and better understand your property tax rate.

Texas law establishes the process followed by local officials in determining the value for property ensuring that values are equal and uniform setting tax rates and. The Tarrant County Tax Assessor Collector collects property taxes for all the taxing jurisdictions in Tarrant County including the. 1 day agoEL PASO Texas City council approved the more than 1 billion annual budget for the upcoming fiscal year and along with it approved the.

Learn about the role and services offered by the. Questions about the citys property tax rate may be directed to the NRH Budget Department at 817-427-6053 or by email. Texas has some of the highest property taxes in the US.

Search Texas Inheritance Tax Rate. Friday 800 AM - Noon. New Hampshires effective tax rate is 218 with Connecticut the only other state with a property tax of over 2 214.

Monday in the Board Room at Big Spring High School 707 E. Counties in Texas collect an average of 181 of a propertys assesed fair market value as property tax per year. Proper communication of any levy increase is another requirement.

Mesquite St Arlington TX 76010817-459-6259TrinaFreemanarlingtontxgov. There are no inheritance or estate taxes in Texas. The board is scheduled to meet for a workshop session at 4 pm.

The proposed tax rate approved at the most recent regular school board meeting Aug. The state repealed the inheritance tax beginning on Sept. To find detailed property tax statistics for any county in Texas click the countys name in the data table above.

New Hampshire rounds up the list of the top three states with the highest property tax. That said you will likely have to file some taxes on behalf of the deceased including. See what makes us different.

The average effective property tax rate in the Lone Star State is 169. Thats up to local taxing units which use tax revenue to provide local services including schools streets and roads police and fire protection and many others. Property taxes are local taxes that provide the largest source of money local governments use to pay for schools streets roads police fire protection and many other services.

The meeting will be at 515 pm. We publish school district tax rate and levy information in conjunction with publishing the School District Property Value Study SDPVS preliminary findings which must be certified to the commissioner of education prior to Feb. Final individual federal and state income tax returns.

The state sales tax rate in Texas is 625 percent. This means that the state does not have an inheritance or an. Your locally elected officials school trustees city council members county commissioners decide your property tax burden.

All property not exempted has to be taxed equally and consistently at present-day market worth. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000. 12 is 09609 per 100 valuation including a Maintenance and Operations rate of 08846 per 100 and an Interest and Sinking rate of 00763 per 100.

Texas has no state property tax. We dont make judgments or prescribe specific policies. Learn about Texas property taxes 4CCCE3C8-C54F-4BB6-AE6D-FF81FD0CDE953x.

We update this information along with the city county and special district rates and levies by August. Overview of Texas Taxes. Therefore Texans need only worry about the federal estate tax.

Links for the 2022 Notice of Tax Rate Notice of Public Hearing and 2022 Tax Rate Calculation Worksheet. 1 Property owners have the right to know about increases in their properties appraised value and. Its effective property tax rate is 247 not much higher than the 227 in Illinois.

Local governments set tax rates and collect property taxes that they use to provide local services including schools streets roads police fire protection and more. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Cities counties and hospital districts may levy a sales tax specifically to reduce property taxes.

We publish school district tax rate and levy information in conjunction with publishing the School District Property Value Study SDPVS preliminary findings which must be certified to the commissioner of education prior to Feb. 1 day agoThe hospital districts 2021 tax rate is 2358 cents per 100 valuation.

How Do State And Local Sales Taxes Work Tax Policy Center

State Corporate Income Tax Rates And Brackets Tax Foundation

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Sales And Use Tax Rates Houston Org

How Do State And Local Individual Income Taxes Work Tax Policy Center

Tarrant County Tx Property Tax Calculator Smartasset

Fiscal Facts Tax Policy Center

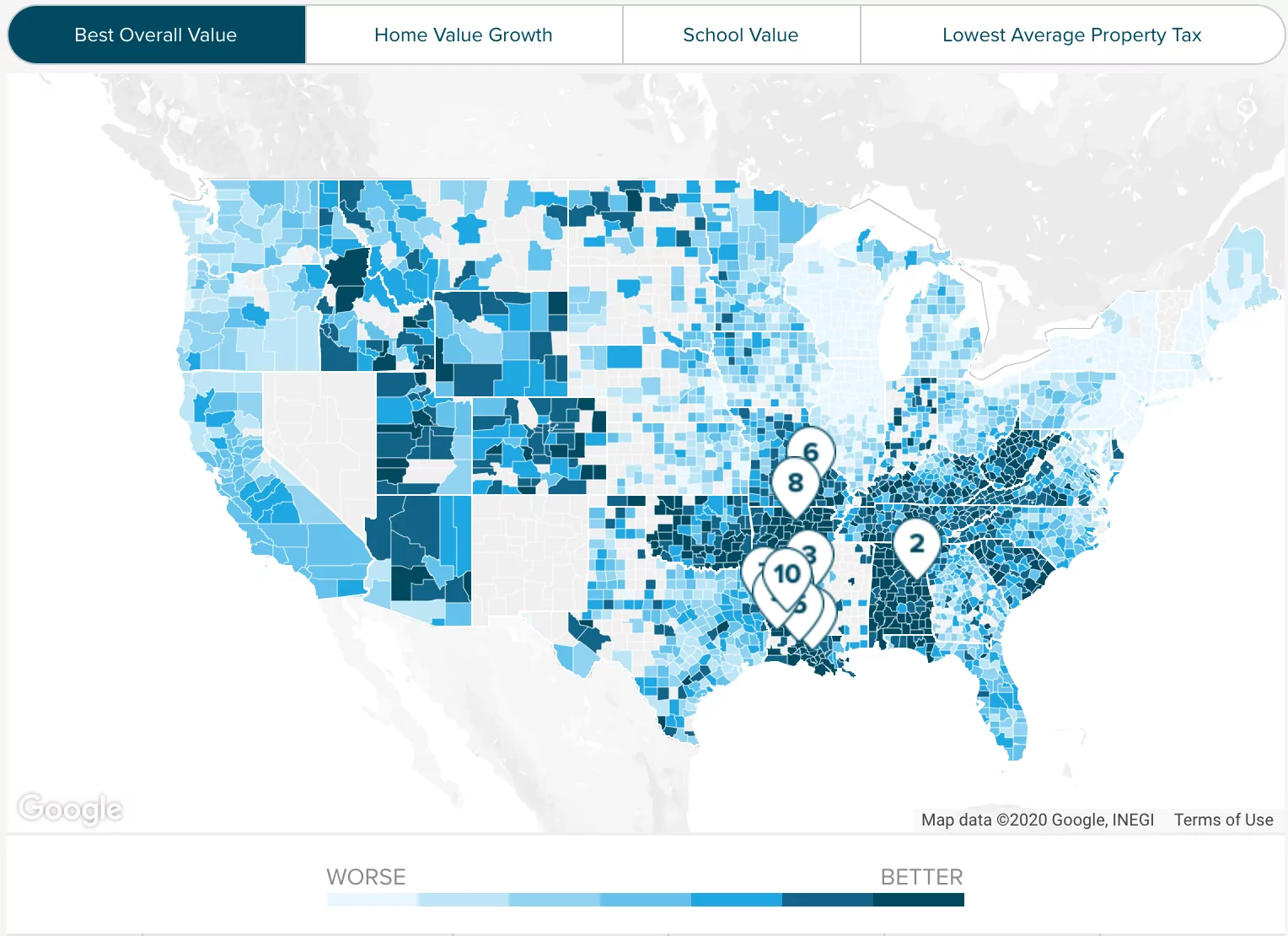

2022 Property Taxes By State Report Propertyshark

State Alcohol Excise Tax Rates Tax Policy Center

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Texas Inheritance Laws What You Should Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Why Are Texas Property Taxes So High Home Tax Solutions

States With No Estate Tax Or Inheritance Tax Plan Where You Die